Learn which accounting method is better for your business.

The cash method and the accrual method (sometimes called cash basis and accrual basis) are the two principal methods of keeping track of a business's income and expenses. In most cases, you can choose which method to use. Learn how they work and the advantages and disadvantages of each so you can choose the better one for your business.

In a nutshell, these methods differ only in the timing of when transactions, including sales and purchases, are credited or debited to your accounts. Here's how each works:

The accrual method. The accrual method is the more commonly used method of accounting. Under the accrual method, transactions are counted when the order is made, the item is delivered, or the services occur, regardless of when the money for them (receivables) is actually received or paid. In other words, income is counted when the sale occurs, and expenses are counted when you receive the goods or services. You don't have to wait until you see the money, or actually pay money out of your checking account, to record a transaction.

The cash method. Under the cash method, income is not counted until cash (or a check) is actually received, and expenses are not counted until they are actually paid.

Example

Your computer installation business finishes a job in November, and doesn't get paid until three months later in January. Under the cash method, you would record the payment in January. Under the accrual method, you would record the income in your November books.

You purchase a new laser printer on credit in May and pay $1,000 for it in July, two months later. Using the cash method, you would record a $1,000 payment for the month of July, the month when the money is actually paid.Under the accrual method, you would record the $1,000 payment in May, when you take the laser printer and become obligated to pay for it.

by Attorney Stephen Fishman

Saturday, March 21, 2009

Cash vs. Accrual Accounting

Friday, March 20, 2009

The Accounting Equation

The resources controlled by a business are referred to as its assets. For a new business, those assets originate from two possible sources:

- Investors who buy ownership in the business

- Creditors who extend loans to the business

| Asset = | Liabilities + Owners'Equity |

| Resources | Claims on the Resources |

| Asset = Liabilities | + Owners'Equity |

| + Revenues | |

| - Expenses | |

| + Gains | |

| - Losses | |

| + Contributions | |

| + Withdrawals |

The accounting equation holds at all times over the life of the business. When a transaction occurs, the total assets of the business may change, but the equation will remain in balance. The accounting equation serves as the basis for the balance sheet, as illustrated in the following example.

The Accounting Equation - A Practical Example

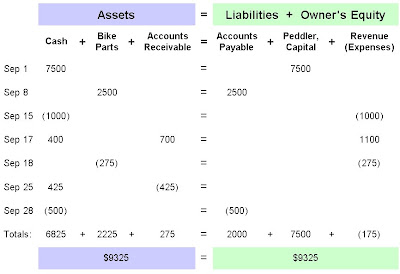

To better understand the accounting equation, consider the following example. Mike Peddler decides to open a bicycle repair shop. To get started he rents some shop space, purchases an initial inventory of bike parts, and opens the shop for business. Here is a listing of the transactions that occurred during the first month:

|

|

|

| Sep 1 | Owner contributes $7500 in cash to capitalize the business. |

| Sep 8 | Purchased $2500 in bike parts on account, payable in 30 days. |

| Sep 15 | Paid first month's shop rent of $1000. |

| Sep 17 | Repaired bikes for $1100; collected $400 cash; billed customers for the $700 balance. |

| Sep 18 | $275 in bike parts were used. |

| Sep 25 | Collected $425 from customer accounts. |

| Sep 28 | Paid $500 to suppliers for parts purchased earlier in the month. |

These transactions affect the accounting equation as shown below.

Note that for each date in the above example, the sum of entries under the "Assets" heading is equal to the sum of entries under the "Liabilities + Owner's Equity" heading. In most of these cases, the transaction affected both sides of the accounting equation. However, note that the Sep 25 transaction affected only the asset side with an increase in cash and an equal but opposite decrease in accounts receivable.

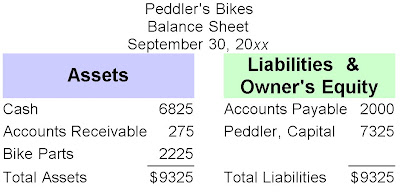

Note that for each date in the above example, the sum of entries under the "Assets" heading is equal to the sum of entries under the "Liabilities + Owner's Equity" heading. In most of these cases, the transaction affected both sides of the accounting equation. However, note that the Sep 25 transaction affected only the asset side with an increase in cash and an equal but opposite decrease in accounts receivable.At the end of the month of September, the net income (revenues minus expenses) is closed to capital and the balance sheet for the business would appear as follows:

The bike parts are considered to be inventory, which appears as an asset on the balance sheet. The owner's equity is modified according to the difference between revenues and expenses. In this case, the difference is a loss of $175, so the owner's equity has decreased from $7500 at the beginning of the month to $7325 at the end of the month.

The bike parts are considered to be inventory, which appears as an asset on the balance sheet. The owner's equity is modified according to the difference between revenues and expenses. In this case, the difference is a loss of $175, so the owner's equity has decreased from $7500 at the beginning of the month to $7325 at the end of the month.Debits and Credits

The above example illustrates how the accounting equation remains in balance for each transaction. Note that negative amounts were portrayed as negative numbers. In practice, negative numbers are not used; in a double-entry bookkeeping system the recording of each transaction is made via debits and credits in the appropriate accounts.

Wednesday, March 18, 2009

Luca Pacioli: The Father of Accounting

Fra Luca Bartolomeo de Pacioli (sometimes Paciolo) (1446/7–1517) was an Italian mathematician and Franciscan friar, collaborator with Leonardo da Vinci, and seminal contributor to the field now known as accounting. He was also called Luca di Borgo after his birthplace, Borgo Santo Sepolcro, Tuscany.

Fra Luca Bartolomeo de Pacioli (sometimes Paciolo) (1446/7–1517) was an Italian mathematician and Franciscan friar, collaborator with Leonardo da Vinci, and seminal contributor to the field now known as accounting. He was also called Luca di Borgo after his birthplace, Borgo Santo Sepolcro, Tuscany.

Pacioli published several works on mathematics, including:

a Latin translation of Euclid's "Elements". The first printed illustration of a rhombicuboctahedron, by Leonardo da Vinci, published in De divina proportione.

The first printed illustration of a rhombicuboctahedron, by Leonardo da Vinci, published in De divina proportione.

Pacioli also wrote an unpublished treatise on chess, De ludo scacchorum (On the Game of Chess). Long thought to have been lost, a surviving manuscript was rediscovered in 2006, in the 22,000-volume library of Count Guglielmo Coronini. A facsimile edition of the book was published in Pacioli's home town of Sansepolcro in 2008. Based on Leonardo da Vinci's long association with the author and his having illustrated De divina proportione, some scholars speculate that Leonardo either drew the chess problems that appear in the manuscript or at least designed the chess pieces used in the problems.

In 1994, accountants from around the world gathered in an Italian village called San Sepulcro to celebrate the 500th anniversary of the first book written on double-entry accounting. The book was written by an Italian friar, Luca Pacioli (pronounced pot-CHEE-oh-lee).

The first accounting book actually was one of five sections in Pacioli's mathematics book titled "Everything about Arithmetic, Geometry, and Proportions." This section on accounting served as the world's only accounting textbook until well into the 16th century.

Because Pacioli was a Franciscan friar, he might be referred to simply as Friar Luca. While Friar Luca is often called the "Father of Accounting," he did not invent the system. Instead, he simply described a method used by merchants in Venice during the Italian Renaissance period. His system included most of the accounting cycle as we know it today. For example, he described the use journals and ledgers, and he warned that a person should not go to sleep at night until the debits equalled the credits! His ledger included assets (including receivables and inventories), liabilities, capital, income, and expense accounts. Friar Luca demonstrated year-end closing entries and proposed that a trial balance be used to prove a balanced ledger. Also, his treatise alludes to a wide range of topics from accounting ethics to cost accounting.

Pacioli was about 49 years old in 1494 - just two years after Columbus discovered America - when he returned to Venice for the publication of his fifth book, Summa de Arithmetica, Geometria, Proportioni et Proportionalita (Everything About Arithmetic, Geometry and Proportion). It was written as a digest and guide to existing mathematical knowledge, and bookkeeping was only one of five topics covered. The Summa's 36 short chapters on bookkeeping, entitled De Computis et Scripturis (Of Reckonings and Writings) were added "in order that the subjects of the most gracious Duke of Urbino may have complete instructions in the conduct of business," and to "give the trader without delay information as to his assets and liabilities" (All quotes from the translation by J.B. Geijsbeek, Ancient Double Entry Bookkeeping: Lucas Pacioli's Treatise, 1914).

Numerous tiny details of bookkeeping technique set forth by Pacioli were followed in texts and the profession for at least the next four centuries, as accounting historian Henry Rand Hatfield put it, "persisting like buttons on our coat sleeves, long after their significance had disappeared." Perhaps the best proof that Pacioli's work was considered potentially significant even at the time of publication was the very fact that it was printed on November 10, 1494. Guttenberg had just a quarter-century earlier invented metal type, and it was still an extremely expensive proposition to print a book.

Accounting practitioners in public accounting, industry, and not-for-profit organizations, as well as investors, lending institutions, business firms, and all other users for financial information are indebted to Luca Pacioli for his monumental role in the development of accounting.

Source: wikipedia, www.acct.tamu.edu

Tuesday, March 17, 2009

Welcome to the World of Accounting

GOALS

Your goals for this "welcoming" chapter are to learn about:

- The nature of financial and managerial accounting information.

- The accounting profession and accounting careers.

- The fundamental accounting equation: Assets = Liabilities + Owners' Equity.

- How transactions impact the fundamental accounting equation.

- The four core financial statements.

DISCUSSION

ACCOUNTING INFORMATION

A QUALITY INFORMATION SYSTEM: Both financial accounting and managerial accounting depend upon a strong information system to reliably capture and summarize business transaction data. Information technology has radically reshaped this mundane part of the practice of accounting during the past 30 years. The era of the "green eye-shaded" accountant has been relegated to the annals of history. Now, accounting is more of a dynamic, decision-making discipline, rather than a bookkeeping task.

INHERENT LIMITATIONS: Accounting data is not absolute or concrete. Considerable amounts of judgment and estimation are necessary to develop the specific accounting measurements that are reported during a particular month, quarter, or year (e.g., how much pension expense should be reported now for the future benefits that are being earned by employees now, but the amounts will not be known with certainly until many years to come?). About the only way around the problem of utilizing estimation in accounting is to wait until all facts are known with certainty before issuing any reports. However, by the time any information could be reported, it would be so stale as to lose its usefulness. Thus, in order to timely present information, it is considered to be far better to embrace reasonable estimations in the normal preparation of ongoing financial reports.

In addition, accounting has not yet advanced to a state of being able to value a business (or a business's assets). As such, many transactions and events are reported based upon on the historical cost principle (in contrast to fair value). This principle holds that it is better to maintain accountability over certain financial statement elements at amounts that are objective and verifiable, rather than opening the door to random adjustments for value changes that may not be supportable. For example, land is initially recorded in the accounting records at its purchase price. That historical cost will not be adjusted even if the fair value is perceived as increasing. While this enhances the "reliability" of reported data, it can also pose a limitation on its "relevance."

THE ACCOUNTING PROFESSION AND CAREERS

THE FUNDAMENTAL ACCOUNTING EQUATION

BALANCE SHEET: The fundamental accounting equation is the backbone of the accounting and reporting system. It is central to understanding a key financial statement known as the balance sheet (sometimes called the statement of financial position). The following illustration for Edelweiss Corporation shows a variety of assets that are reported at a total of $895,000. Creditors are owed $175,000, leaving $720,000 of stockholders' equity. The stockholders' equity section is divided into the $120,000 originally invested in Edelweiss Corporation by stockholders (i.e., capital stock), and the other $600,000 that was earne

d (and retained) by successful business performance over the life of the company.

d (and retained) by successful business performance over the life of the company.Does the stockholders' equity total mean the business is worth $720,000? No! Why not? Because many assets are not reported at current value. For example, although the land cost $125,000, the balance sheet does not report its current worth. Similarly, the business may have unrecorded resources to its credit, such as a trade secret or a brand name that allows it to earn extraordinary profits. If one is looking to buy stock in Edelweiss Corporation, they would surely give consideration to these important non-financial statement based valuation considerations. This observation tells us that accounting statements are important in investment and credit decisions, but they are not the sole source of information for making investment and credit decisions.

HOW TRANSACTIONS IMPACT THE ACCOUNTING EQUATION

THE IMPACT OF TRANSACTIONS: The preceding balance sheet for Edelweiss was static. This means that it represented the financial condition at the noted date. But, each passing transaction or event brings about a change in the overall financial condition. Business activity will impact various asset, liability, and/or equity accounts; but, they will not disturb the equality of the accounting equation. So, how does this happen? To reveal the answer to this question, let's look at four specific transactions for Edelweiss Corporation. You will see how each transaction impacts the individual asset, liability, and equity accounts, without upsetting the basic equality of the overall balance sheet.

EDELWEISS COLLECTS AN ACCOUNT RECEIVABLE: If Edelweiss Corporation collected $10,000 from a customer on an existing account receivable (i.e., not a new sale, just the collection of an amount that is due from some previous transaction), then the balance sheet would be revised as follows:

This illustration plainly shows that cash (an asset) increased from $25,000 to $35,000, and accounts receivable (an asset) decreased from $50,000 to $40,000. As a result total assets did not change, and liabilities and equity accounts were unaffected. Thus, assets still equal liabilities plus equity.

EDELWEISS BUYS EQUIPMENT WITH LOAN PROCEEDS: Now, if Edelweiss Corporation purchased $30,000 of equipment, agreeing to pay for it later (i.e. taking out a loan), then the balance sheet would be further revised as follows:

This illustration shows that equipment (an asset) increased from $250,000 to $280,000, and loans payable (a liability) increased from $125,000 to $155,000. As a result, both total assets and total liabilities increased by $30,000, but assets still equal liabilities plus equity.

This illustration shows that equipment (an asset) increased from $250,000 to $280,000, and loans payable (a liability) increased from $125,000 to $155,000. As a result, both total assets and total liabilities increased by $30,000, but assets still equal liabilities plus equity.EDELWEISS PROVIDES SERVICES TO A CUSTOMER ON ACCOUNT: What would happen if Edelweiss Corporation did some work for a customer in exchange for the customer's promise to pay $5,000? This requires further explanation; try to follow this logic closely! You already know that retained earnings is the income of the business that has not been distributed to the owners of the business. When Edelweiss Corporation earned $5,000 (which they will collect later) by providing a service to a customer, it can be said that they generated revenue of $5,000. Revenue is the enhancement to assets resulting from providing goods or services to customers. Revenue will bring about an increase income, and income is added to retained earnings. Can you follow that?

As you examine the following balance sheet, notice that accounts receivable and retained earnings went up by $5,000 each, indicating that the business has more assets and more retained earnings. And, guess what: assets still equal liabilities plus equity.

EDELWEISS PAYS EXPENSES WITH CASH: It would be nice if you could run a business without incurring any expenses. However, such is not the case. Expenses are the outflows and obligations that arise from the producing goods and services. Imagine that Example Corporation paid $3,000 for expenses:

GENERALIZING ABOUT THE IMPACT OF TRANSACTIONS: There are countless types of transactions that can occur, and each and every transaction can be described in terms of its impact on assets, liabilities, and equity. What is important to know is that no transaction will upset the fundamental accounting equation of assets = liabilities + owners' equity.

DISTINGUISHING BETWEEN REVENUE AND INCOME: In day-to-day conversation, some terms can often be used casually and without a great deal of precision. Words may be treated as synonymous, when in fact they are not. Such is the case for the words "income" and "revenue." Each term has a very precise meaning, and you should accustom yourself to the correct usage. It has already been pointed out that revenues are enhancements resulting from providing goods and services to customers. Conversely, expenses can generally be regarded as costs of doing business. This gives rise to another "accounting equation":

Revenue is the "top line" amount corresponding to the total benefits generated from business activity. Income is the "bottom line" amount that results after deducting the expenses from revenue. In some countries, revenue is also referred to as "turnover."

THE CORE FINANCIAL STATEMENTS

Your future will undoubtedly be marked by numerous decisions about investing money in the capital stock of some corporation. Another option that will present itself is to loan money to a company, either directly, or by buying that company's debt instruments known as "bonds." Stocks and bonds are two of the most prevalent financial instruments of the modern global economy. The financial press and television devote seemingly endless coverage to headline events pertaining to large public corporations. Public companies are those with securities that are readily available for purchase/sale through organized stock markets. Many more companies are private, meaning their stock and debt is in the hands of a narrow group of investors and banks.

If you are contemplating an investment in a public or private entity, there is certain information you will logically seek to guide your decision process. What types of information will you desire? What do you want to know about the companies in which you are considering an investment? If you were to prepare a list of questions for the company's management, what subjects would be included? Whether this challenge is posed to a sophisticated investor or to a new business student, the listing almost always includes the same basic components.

What are the corporate assets? Where does the company operate? What are the key products? How much income is being generated? Does the company pay dividends? What is the corporate policy on ethics and environmental responsibility?

Many such topics are noted within the illustrated "thought cloud." Some of these topics are financial in nature (noted in blue). Other topics are of more general interest and cannot be communicated in strict mathematical terms (noted in red).

Financial accounting seeks to directly report information for the topics noted in blue. Additional supplemental disclosures frequently provide insight about subjects such as those noted in red. But, you would also need to gain additional information by reviewing corporate web sites (many have separate sections devoted to their investors), filings with the securities regulators, financial journals and magazines, and other such sources. Most companies will have annual meetings for shareholders and host web casts every three months (quarterly). These events are very valuable in allowing investors and creditors to make informed decisions about the company, as well as providing a forum for direct questioning of management. You might even call a company and seek "special insight" about emerging trends and developments. Be aware, however, that the company will likely not be able to respond in a meaningful way. Securities laws have very strict rules and penalties that are meant to limit selective or unique disclosures to any one investor or group (in the United States: Regulation Full Disclosure/Reg. FD). It is always amusing, but rarely helpful, to review "message boards" where people anonymously post their opinions about a particular company.

FINANCIAL STATEMENTS: Financial accounting information is conveyed through a standardized set of reports. You have already been introduced to the balance sheet. The other fundamental financial statements are the income statement, statement of retained earnings, and statement of cash flows. There are many rules that govern the form and content of each financial statement. At the same time, those rules are not so rigid as to preclude variations in the exact structure or layout. For instance, the earlier illustration for Edelweiss was first presented as a "horizontal" layout of the balance sheet. The subsequent Edelweiss examples were representative of "vertical" balance sheet arrangements. Each approach, and others, is equally acceptable. The basic form and content of each core financial statement is as follows:

INCOME STATEMENT: A summary of an entity's results of operation for a specified period of time is revealed in the income statement, as it provides information about revenues generated and expenses incurred. The difference between the revenues and expenses is identified as the net income or net loss. The income statement can be prepared using a single-step or a multiple-step approach, and might be further modified to include a number of special disclosures relating to unique items. These topics will be amplified in a number of subsequent chapters. For now, take careful note that the income statement relates to activities of a specified time period (e.g., year, quarter, month), as is clearly noted in its title:

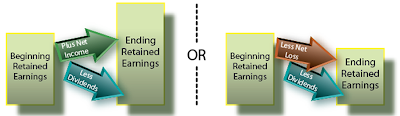

THE STATEMENT OF RETAINED EARNINGS: The example balance sheets for Edelweiss revealed how retained earnings increased and decreased in response to events that impacted income. You also know that retained earnings is reduced by dividends paid to shareholders.

The statement of retained earnings provides a succinct reporting of these changes in retained earnings from one period to the next. In essence, the statement is nothing more than a reconciliation or "bird's-eye view" of the bridge between the retained earnings amounts appearing on two successive balance sheets:

The statement of retained earnings provides a succinct reporting of these changes in retained earnings from one period to the next. In essence, the statement is nothing more than a reconciliation or "bird's-eye view" of the bridge between the retained earnings amounts appearing on two successive balance sheets: If you examine very many sets of financial statements, you will soon discover that many companies provide an expanded statement of stockholders' equity in lieu of the required statement of retained earnings. The statement of stockholders' equity portrays not only the changes in retained earnings, but also changes in other equity accounts such as capital stock. The expanded statement of stockholders' equity is presented in a subsequent chapter.

If you examine very many sets of financial statements, you will soon discover that many companies provide an expanded statement of stockholders' equity in lieu of the required statement of retained earnings. The statement of stockholders' equity portrays not only the changes in retained earnings, but also changes in other equity accounts such as capital stock. The expanded statement of stockholders' equity is presented in a subsequent chapter.BALANCE SHEET: The balance sheet focuses on the accounting equation by revealing the economic resources owned by an entity and the claims against those resources (liabilities and owners' equity). The balance sheet is prepared as of a specific date, whereas the income statement and statement of retained earnings cover a period of time. Accordingly, it is sometimes said that balance sheets portray financial position (or condition) while other statements reflect results of operations. Quartz's balance sheet is as follows:

STATEMENT OF CASH FLOWS: The statement of cash flows details the enterprise's cash flows. This operating statement reveals how cash is generated and expended during a specific period of time. It consists of three unique sections that isolate the cash inflows and outflows attributable to (a) operating activities, (b) investing activities, and (c) financing activities. Notice that the cash provided by operations is not the same thing as net income found in the income statement. This result occurs because some items hit income and cash flows in different periods. For instance, remember how Edelweiss (from the earlier illustration) generated income from a service provided on account. That transaction increased income without a similar effect on cash. These differences tend to even out over time.

Suffice it to say that the underpinnings of the statement cash flows require a fairly complete knowledge of basic accounting. Do not be concerned if you feel like you lack a complete comprehension at this juncture. A future chapter is devoted to the statement.

ARTICULATION: It is important for you to take note of the fact that the income statement, statement of retained earnings, and balance sheet articulate. This means they mesh together in a self-balancing fashion. The income for the period ties into to the statement of retained earnings, and the ending retained earnings ties into the balance sheet. This final tie-in causes the balance sheet to balance. These relationships are illustrated in the following diagram.

UNLOCKING THE MYSTERY OF ARTICULATION: It seems almost magical that the final tie-in of retained earnings will exactly cause the balance sheet to balance. This is reflective of the brilliance of Pacioli's model, and is indicative of why it has survived for centuries. This link jumps to a series of web pages that comprehensively illustrate how transactions impact the income statement, statement of retained earnings, and balance sheet. To conclude this chapter, you should click through the pages and study the impact of each transaction on the financial statements.

Source: principles of accounting

Source: principles of accountingSunday, March 15, 2009

What is Accounting?

Accounting can be defined as follows:

Accounting is the art of recording, summarizing, reporting, and analyzing financial transactions.

[American Institute of Certified Public Accountant]

Accounting is a service activity which provides financial quantitative information about economic entity that can be useful in decision making.

[American Principle Board]

Accounting is the process of keeping track of the changes a user implemented in a computing system.

[techFAQ]

Accountancy or accounting is the system of recording, verifying, and reporting of the value of assets, liabilities, income, and expenses in the books of account (ledger) to which debit and credit entries (recognizing transactions) are chronologically posted to record changes in value

[Wikipedia]

Quite simply, accounting is a language: a language that provides information about the financial position of an organization. When you study accounting you are essentially learning this specialized language. By learning this language you can communicate and understand the financial operations of any and all types of organizations.

[MoneyInstructor]

Accountancy (profession) or accounting (methodology) is the measurement, disclosure or provision of assurance about financial information that helps managers, investors, tax authorities and other decision makers make resource allocation decisions.

[School of Business Administration]

To put it simply, accounting is about keeping track of the money. Accounting is how businesses monitor income, expenses, and assets over a given period of time. Accounting often is referred to as "the language of business" because of its role in maintaining and processing all relevant financial information that an entity or company requires for its managing and reporting purposes. Accounting is a field of specialization critical to the functioning of all types of organizations.

Accounting is also a body of principles and conventions, as well as an established general process for capturing financial information related to an organization’s resources. Accounting is a service function that provides information of value to all operating units and to other service functions, such as the headquarters offices of a large corporation.

[TopAccountingDegrees]

Accounting refers to the practice of tracking a business's income and expenses and using those figures to evaluate its financial status.

[allbusiness]