The resources controlled by a business are referred to as its assets. For a new business, those assets originate from two possible sources:

- Investors who buy ownership in the business

- Creditors who extend loans to the business

| Asset = | Liabilities + Owners'Equity |

| Resources | Claims on the Resources |

Initially, owner equity is affected by capital contributions such as the issuance of stock. Once business operations commence, there will be income (revenues minus expenses, and gains minus losses) and perhaps additional capital contributions and withdrawals such as dividends. At the end of a reporting period, these items will impact the owners' equity as follows:

| Asset = Liabilities | + Owners'Equity |

| + Revenues | |

| - Expenses | |

| + Gains | |

| - Losses | |

| + Contributions | |

| + Withdrawals |

These additional items under owners' equity are tracked in temporary accounts until the end of the accounting period, at which time they are closed to owners' equity.

The accounting equation holds at all times over the life of the business. When a transaction occurs, the total assets of the business may change, but the equation will remain in balance. The accounting equation serves as the basis for the balance sheet, as illustrated in the following example.

The Accounting Equation - A Practical Example

To better understand the accounting equation, consider the following example. Mike Peddler decides to open a bicycle repair shop. To get started he rents some shop space, purchases an initial inventory of bike parts, and opens the shop for business. Here is a listing of the transactions that occurred during the first month:

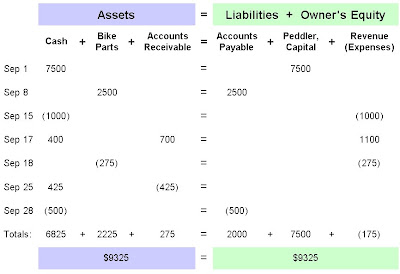

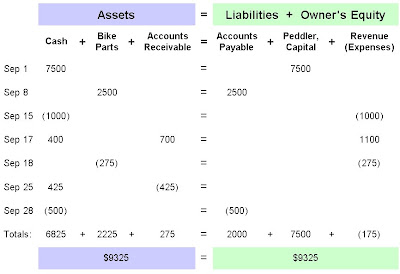

These transactions affect the accounting equation as shown below.

Note that for each date in the above example, the sum of entries under the "Assets" heading is equal to the sum of entries under the "Liabilities + Owner's Equity" heading. In most of these cases, the transaction affected both sides of the accounting equation. However, note that the Sep 25 transaction affected only the asset side with an increase in cash and an equal but opposite decrease in accounts receivable.

Note that for each date in the above example, the sum of entries under the "Assets" heading is equal to the sum of entries under the "Liabilities + Owner's Equity" heading. In most of these cases, the transaction affected both sides of the accounting equation. However, note that the Sep 25 transaction affected only the asset side with an increase in cash and an equal but opposite decrease in accounts receivable.

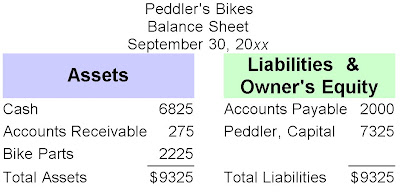

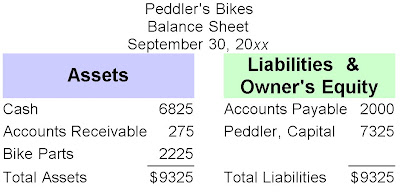

At the end of the month of September, the net income (revenues minus expenses) is closed to capital and the balance sheet for the business would appear as follows:

The bike parts are considered to be inventory, which appears as an asset on the balance sheet. The owner's equity is modified according to the difference between revenues and expenses. In this case, the difference is a loss of $175, so the owner's equity has decreased from $7500 at the beginning of the month to $7325 at the end of the month.

The bike parts are considered to be inventory, which appears as an asset on the balance sheet. The owner's equity is modified according to the difference between revenues and expenses. In this case, the difference is a loss of $175, so the owner's equity has decreased from $7500 at the beginning of the month to $7325 at the end of the month.

Debits and Credits

The above example illustrates how the accounting equation remains in balance for each transaction. Note that negative amounts were portrayed as negative numbers. In practice, negative numbers are not used; in a double-entry bookkeeping system the recording of each transaction is made via debits and credits in the appropriate accounts.

The accounting equation holds at all times over the life of the business. When a transaction occurs, the total assets of the business may change, but the equation will remain in balance. The accounting equation serves as the basis for the balance sheet, as illustrated in the following example.

The Accounting Equation - A Practical Example

To better understand the accounting equation, consider the following example. Mike Peddler decides to open a bicycle repair shop. To get started he rents some shop space, purchases an initial inventory of bike parts, and opens the shop for business. Here is a listing of the transactions that occurred during the first month:

|

|

|

| Sep 1 | Owner contributes $7500 in cash to capitalize the business. |

| Sep 8 | Purchased $2500 in bike parts on account, payable in 30 days. |

| Sep 15 | Paid first month's shop rent of $1000. |

| Sep 17 | Repaired bikes for $1100; collected $400 cash; billed customers for the $700 balance. |

| Sep 18 | $275 in bike parts were used. |

| Sep 25 | Collected $425 from customer accounts. |

| Sep 28 | Paid $500 to suppliers for parts purchased earlier in the month. |

These transactions affect the accounting equation as shown below.

Note that for each date in the above example, the sum of entries under the "Assets" heading is equal to the sum of entries under the "Liabilities + Owner's Equity" heading. In most of these cases, the transaction affected both sides of the accounting equation. However, note that the Sep 25 transaction affected only the asset side with an increase in cash and an equal but opposite decrease in accounts receivable.

Note that for each date in the above example, the sum of entries under the "Assets" heading is equal to the sum of entries under the "Liabilities + Owner's Equity" heading. In most of these cases, the transaction affected both sides of the accounting equation. However, note that the Sep 25 transaction affected only the asset side with an increase in cash and an equal but opposite decrease in accounts receivable.At the end of the month of September, the net income (revenues minus expenses) is closed to capital and the balance sheet for the business would appear as follows:

The bike parts are considered to be inventory, which appears as an asset on the balance sheet. The owner's equity is modified according to the difference between revenues and expenses. In this case, the difference is a loss of $175, so the owner's equity has decreased from $7500 at the beginning of the month to $7325 at the end of the month.

The bike parts are considered to be inventory, which appears as an asset on the balance sheet. The owner's equity is modified according to the difference between revenues and expenses. In this case, the difference is a loss of $175, so the owner's equity has decreased from $7500 at the beginning of the month to $7325 at the end of the month.Debits and Credits

The above example illustrates how the accounting equation remains in balance for each transaction. Note that negative amounts were portrayed as negative numbers. In practice, negative numbers are not used; in a double-entry bookkeeping system the recording of each transaction is made via debits and credits in the appropriate accounts.

Good and useful information. God is Great. Let us pray for peace for the world. Wish you all the best.

http://health-care-you.blogspot.com

@Mahmood

Thanks you very much...